In a crisis, long-term planning may lose out to quick and dirty solutions — regardless of the consequences.

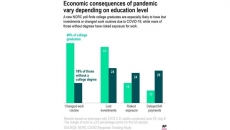

As the pandemic and its economic fallout continues, more cash-strapped consumers could fall into this trap if the Great Recession is any indicator.

A recent report by the Consumer Financial Protection Bureau found that from 2007 through 2010, debt settlements — which can be financially risky — increased. Meanwhile, credit counselling, a debt relief option that keeps consumers in good standing with their creditors, declined.

Before you hit a moment of crisis decision-making, understand how to think through debt relief options.

WHY DEBT SETTLEMENT ISN’T ALL IT’S MARKETED TO BE

You’ve probably heard the radio ads or maybe received a robocall promising a solution to your debt that can cut what you owe by 50% or more.

Debt settlement claims are as lofty as the industry’s marketing budget. But these programs aren’t all they’re hyped up to be — and the ads gloss over the downsides.

With debt settlement, you stop making payments to creditors and instead direct your money to the debt settlement company, which holds it in an escrow account. Then, typically after several months, the company contacts your creditors and haggles to cut a deal where the creditor accepts less than originally owed. This period of waiting between when you stop paying creditors and the debt is settled (which isn’t guaranteed) is where things can go awry.

“There’s no free lunch,” says Glenn Downing, a Miami certified financial planner. “There really are some significant trade-offs with debt settlement. I’d try to make it a last resort.”

Debt settlement risks include:

— LEAVING YOURSELF OPEN TO LAWSUITS: When you stop making payments to creditors and debts go delinquent, you can be sued by the original creditor or by a debt collector who purchases the debt. Until the debt is resolved, either through full payment, settlement or bankruptcy, you’re at risk of being sued.

— OWING A TAX BILL: The IRS considers any amount of debt settled as taxable income.

— SAVING LESS THAN WHAT WAS ADVERTISED: Debt settlement companies often take a fee of around 30% of your original debt balance. So even if you did settle for 50% of what you originally owed, you won’t come out as far ahead as you might expect after you pay the fee to the settlement company. Additionally, your debt can continue to grow when you stop making payments, as late fees and interest are added to your balance.

— CREDIT DAMAGE: Missing payments and defaulting on your debts are among the worst things you can do to your credit. These marks stay on your credit reports for around seven years and will make you look risky to future creditors, which can result in you not being approved for credit or having to pay higher interest rates.

A BETTER CHOICE FOR LONG-TERM FINANCIAL HEALTH

What if there was a way to roll multiple credit card payments into one, at a lower interest rate — while preserving your good standing with your creditors?

That’s what credit counselling from non-profit credit counselling agencies offer. These organizations have arrangements with many credit card companies that provide a lower interest rate in exchange for regular monthly payments over three to five years to resolve your debt.

But many consumers aren’t aware of these benefits, according to a 2018 Harris Poll survey commissioned by Money Management International, a non-profit credit counselling agency. It found that 62% of the 2,012 respondents didn’t know credit counselling can roll multiple credit card debts into one payment. And 73% weren’t aware that credit counselling offers lower interest rates on credit card debt.

Credit counselling does have drawbacks. You typically need a regular income to qualify, and if you miss a payment, the agreement can be dissolved, leaving you to manage on your own.

But for the long-term health of your credit profile, credit counselling is the clear winner. This debt relief tool generally keeps consumers in good standing with creditors since they’re making good on their obligations. The only harm to their credit profile would come from closing credit accounts, which some agencies require.

To find a reputable non-profit credit counselling agency, look for one that has been certified by the National Foundation for Credit Counseling or the Financial Counseling Association of America.

KNOW WHEN A THIRD OPTION MIGHT BE BEST

Before choosing debt settlement or credit counselling, consider whether:

— You’re barely able to make regular debt payments.

— Your monthly debt payments — excluding student loans and housing costs — exceed 40% of your take-home pay.

— Your debt burden is interfering with your quality of life, for instance keeping you up at night.

If so, you might want to consider bankruptcy. Although it’s been stigmatized, this debt relief tool can resolve what you owe faster than credit counselling or debt settlement. In addition, credit scores can start to rebound quickly in the months after filing.